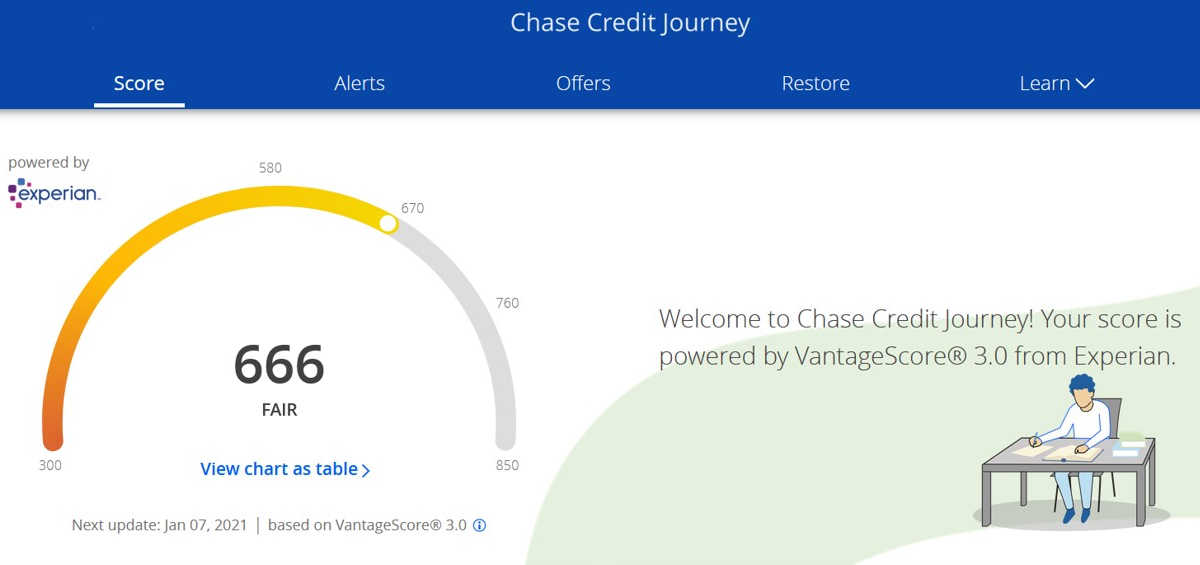

Chase Credit Journey lets you monitor your VantageScore 3.0 credit score for free, even if you aren’t a Chase customer. You’ll gain access to email alerts, a score simulator showing you how financial choices affect your credit, weekly score updates, and alerts concerning credit changes to your report. Check out this Chase Credit Journey review to learn everything you need to know about this tool.

What is Chase Credit Journey?

Chase Credit Journey is a credit monitoring service that provides free access to VantageScore 3.0 (by TransUnion). This score is based on information from your credit report and is refreshed frequently (usually weekly). But there is much more to this tool, including the following features:

- Analysis of your credit score (plus a comparison to other Americans’ scores);

- Score simulator which shows how certain actions can affect your credit score;

- Summary of total credit balance, credit utilization rate and late payments across credit accounts;

- History of your credit scores in a graph, starting with your credit score on the day you sign up and continuing for 12-month intervals;

- Tailored insights into factors behind the credit score to help you manage your credit health.

The service is available to consumers for free, regardless if you are a Chase customer or not.

How Chase Credit Journey Works

Your VantageScore 3.0 credit score provided through Credit Journey is based on data from TransUnion, one of the three major credit bureaus. Your VantageScore is different from your FICO score, which is the score most lenders use when evaluating your credit application.

If you don’t already have a Credit Journey account, you can enroll on the Chase website. Once you’re signed up, you can view your score and most recent TransUnion credit report at any time for free, as well as all the other tools they provide.

Chase Credit Journey Features & Benefits

Once you log into the Chase Credit Journey portal you will default to the page with your credit score. However, there are several other tabs that provide other great features like alerts, special Chase offers customized to you and

Score

As mentioned before your login will default to the “Score” tab, which provides your current credit score, and the factors that contribute to your score such as your credit usage, total balances, available credit, late payments, etc..

One of the features I like about this is the total balances box which provides a list of all open accounts you have and what the balances are, as reported by Experian. This is so much easier that having to dig through your credit report to find this information. It even breaks the accounts down by the various credit types: Revolving, Installment and Real Estate Accounts.

Alerts

The next tab for you to review is the “alerts” tab. If there are any alerts that you need to be aware of they will be displayed here. These alerts can be from both identity and credit monitoring.

Offers

The offers section is where Chase earns it return for this tool. Here they provide several targeted offers for you including credit cards, mortgages and auto loans.

Restore

The restore section if for identity restoration if someone has stolen your identity. Here they will help you identify suspicious activity, work with you to help fix it and provide up to $1 million in Insurance for eligible expenses.

Simulator

The Chase Credit Journey also offers a score simulator to help you understand how different factors affect your credit score. To use this tool, just scroll down the main page and click on the Score Simulator “Try it out” button.

Here you will find your current score along with your simulated score. To adjust the simulated score, use the factors listed below the scores. Adjust the factors to see how your credit will be affected by things like opening a new credit card, paying down a balance, taking out a mortgage, or missing a payment.

Credit Score Factors

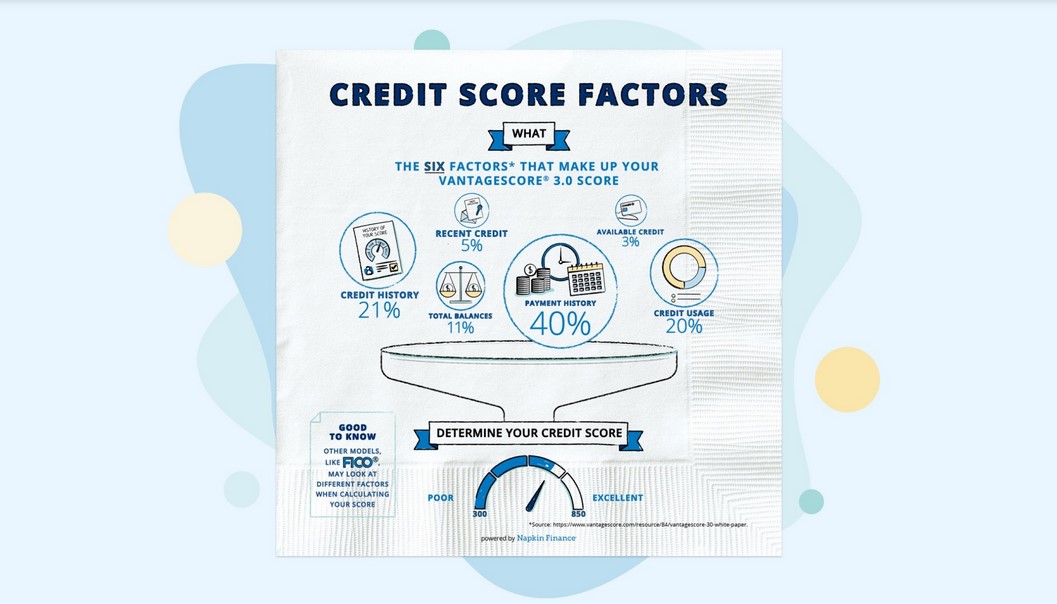

Your VantageScore 3.0 credit score is based on 6 main criteria:

- Payment History: The biggest factor in your VantageScore 3.0 credit scores is payment history and if you are paying on time. Late payments are usually reported if they are more than 30 days past due, and will be visible on your credit report for 7-10 years.

- Age and Type of Credit: VantageScore 3.0 also factors in how long you’ve had different types of credit accounts open. It’s good to show that you have been responsible with credit for a long time, so your oldest account’s age is important. If you close your oldest account, your score could be negatively impacted.

- Credit Utilization: This is the percent of your current credit limit that you are using. You want a low number here — it shows creditors that you don’t max out your available credit. Generally, a ratio under 30% is considered good.

- Recent Credit: This is the number of requests that have been made to see your credit history in the previous 2 years. This includes credit inquiries and newly opened credit accounts.

- Balances: This is the current amount owed over all lines of credit. Lenders generally like to see low balances on your other credit accounts, as it suggests the chances of you making on-time payments each month is higher. While it’s good to keep this number low, keep in mind this includes things like mortgages, so it can be high without having a negative effect on your credit score.

- Available Credit: This is the current amount of unused credit you have over all of your accounts. The number itself isn’t as important as the utilization ratio. You may have a lot of available credit, but as long as you aren’t using it all, it’s OK for this number to be big.

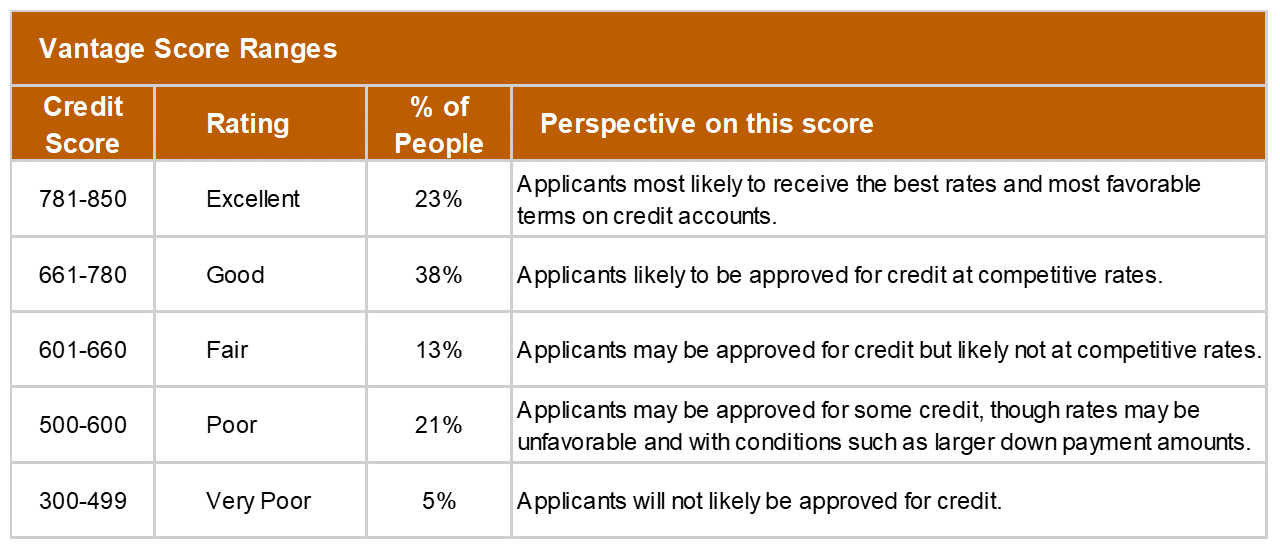

These 6 factors all combine to determine your credit score, which will range between 300-850. Here is an image to show what is a good and bad score and what that means for your loan application.

A good or excellent credit score will help you get the best terms and lowest interest rates on loans. A poor credit score will make thing much more challenging. The Chase Credit Journey tool is a great way to monitor and know exactly where your credit standing is at all times.

What is Credit and Why it’s Important

What is Credit and Why it’s Important