Credit is the ability to borrow money or access goods or services with the understanding that you’ll pay later. Lenders, merchants, and service providers (known collectively as creditors) grant credit based on their confidence you can be trusted to pay back what you borrowed, along with any finance charges that may apply.

To the extent that creditors consider you worthy of their trust, you are said to be creditworthy, or to have “good credit.” Working to improve your credit helps ensure you’ll qualify for loans when you need them.

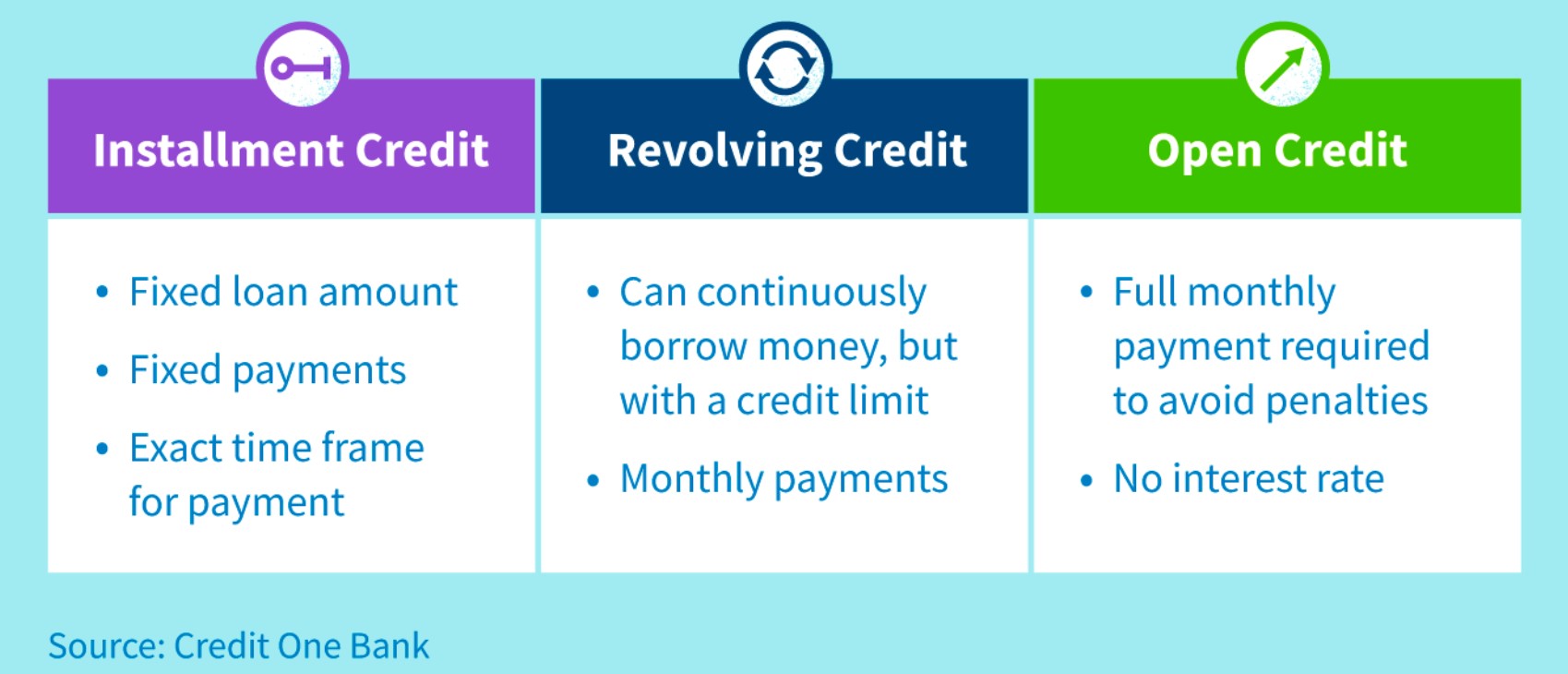

There are three types of credit accounts: revolving, installment and open. This article will help you learn more about them, so you understand the basic principles of credit and credit scores.

How Credit Works

When it comes to credit, there are two important aspects to consider: your credit report and your credit score.

Your credit report is a detailed summary of your personal credit history. It lists everything that potential lenders can review when deciding about entering into a financial contract with you.

Your credit score has a numerical value based on an algorithm. The algorithm analyzes your borrowing/credit utilization and repayment patterns (in the credit report) and measures your reliability as a borrower. The two primary types of credit scores and FICO and VantageScore.

Types of Credit

The three types of credit accounts are revolving accounts, installment accounts and open accounts. These credit types vary based on the term length (fixed or indefinite), payment schedule (fixed or variable), and monthly amount due (full balance or minimum).

Of the three, the two most common are installment loans and revolving credit, but all three are important when it comes to determining how creditworthy you are.

Revolving Accounts

A revolving credit account is one that allows you to borrow money against a line of credit and pay it back over time with monthly payments. Revolving credit accounts usually come with assigned credit limits and are subject to finance charges and fees.

Examples Include:

- Credit Cards

- Personal Lines of Credit

- Home Equity Line of Credit

Installment Accounts

An installment credit account is a loan with fixed payments and an established repayment schedule. Unlike revolving credit, installment credit gives you an exact time frame to pay off the total amount that was borrowed, generally over a period of months to years.

Examples Include:

- Student loans

- Auto loans

- Mortgage

Open Accounts

The least common of the three is an open credit account which comes with a credit line that allows you to make electronic purchases like a credit card. American Express offers both Charge Cards and Credit Cards, so it can be easy to confuse the two.

Unlike a credit card, charge cards don’t come with interest rates, but you are required to pay your balance in full each month to avoid penalties. Every open account has a balance that must be paid in full each month.

Examples Include:

- Charge Cards

- Utility Bills

- Cell Phone Bills

Credit Mix

Ideally, it’s best to have a variety of all three types of credit as this will create a good “credit mix”, which makes up 10-20% of your overall credit score (depending on the model that is used). Your credit scores and credit reports represent how well you manage the three types of credit.

Good vs. Bad Credit

Having good credit means that you are making regular payments on time, on each of your accounts, until your balance is paid in full. This will result in a higher credit score. Alternately, bad credit means you have had a hard time holding up your end of the bargain; you may not have paid the full minimum payments or not made payments on time. People with bad credit have lower credits scores and pay higher rates on loans if they get accepted.

Why is it Important?

Good credit is necessary if you plan to borrow money for major purchases, such as a car or a home. A higher credit score, associated with having good credit, can result in better interest rates and terms on loans and credit cards.

However, Lenders aren’t the only ones who are interesting in your credit reports and credit scores. The following are additional example of entities that may want to see your credit score:

- Landlords – They may check your credit when deciding if they’ll rent an apartment to you.

- Insurance companies – They may use your credit scores as factors in determining your rates.

- Utility companies – They may check your credit before deciding to let you open an account.

- Prospective employers– They may use information found in credit reports when considering if they should hire you.

Credit is a tool that can help you buy things you need now and pay for them over time. Establishing and building up good credit over time is an important element of your overall financial picture.

What’s a VantageScore?

What’s a VantageScore?