Table of Contents[Hide][Show]

While it may not be a subject that’s on the forefront of your mind, it’s important to understand what your credit score is and check it regularly. Your credit score and credit history are among the most important factors that determine your ability to obtain any type of loan and the interest rate you’ll pay, so it’s important to ensure the information on your credit report is accurate and complete.

In this article, we will review the basics of a credit score, including what is a good FICO score and how is it calculated.

What’s a Credit Score?

When you apply for an account with a bank or other financial institution, they will request a copy of your credit report from one of the three major credit reporting agencies: Experian, TransUnion, or Equifax. Your credit report contains information about all of the previous loan relationships you’ve had. This includes, when you opened the account, what it was for (mortgage, car loan, credit card, etc.), and if you paid on time. When you have good credit (meaning you’ve shown that you have handled debt responsibly in the past), you receive a high credit score, which will improve your chances of being approved for a new loan and getting a lower interest rate on that loan.

When you open any type of loan account with a financial institution (credit card, mortgage, car loan, student loan, retail charge card, etc.), the lender is responsible for reporting that information to the three credit reporting agencies. The information reported includes items such as:

- When was the account opened

- What is the credit limit and your current balance

- The current payment status of the account

- Your delinquency history (have you missed any payment and when)

- The account status (is it currently open, closed, in dispute, charged off, etc.)

This information that is reported to the credit reporting agencies is used to determine your credit rating. Most creditors report account information monthly, although the timing may vary slightly from lender to lender, so it’s best to seek that information directly from your lender. For instance, many lenders don’t report an account as delinquent until two payments have been missed, but you shouldn’t assume that all creditors follow the same practice.

What is a FICO Score?

A FICO score is just one type of credit score, albeit the most popular. The FICO score was created by the Fair Isaac Corporation, which first introduced the “credit risk score” in 1981.

A FICO Score is a three-digit number, between 300 – 850, based on the information found in your credit reports. The higher the score the better, which helps lenders determine your creditworthiness and how likely you are to repay a loan. Consequently, this will have an impact on the amount you can borrow, how long you will have to repay the loan, and what interest rate will be offered to you

Is a FICO Score the Same as a Credit Score?

No, a FICO score is a type of credit score. It’s the most popular type of credit score, but it is not the only one out there. There are other companies that use different scoring models to determine your credit score. We won’t get into the specifics in this article, but VantageScore is another commonly used model for calculating your creditworthiness.

Why are FICO Scores important?

FICO Scores help millions of people gain access to the credit they need to do things like get buy a home, get a credit card, or cover medical expenses. Even some insurance and utility companies will check FICO Scores when setting up the terms of the service. A potential new employer may check it out too!

The fact is, a good FICO Score can save you thousands of dollars in interest and fees as lenders are more likely to extend lower rates if you present less of a risk for them. It also shows that you are a responsible person, at least from a financial standpoint 🙂

How are FICO Scores Calculated?

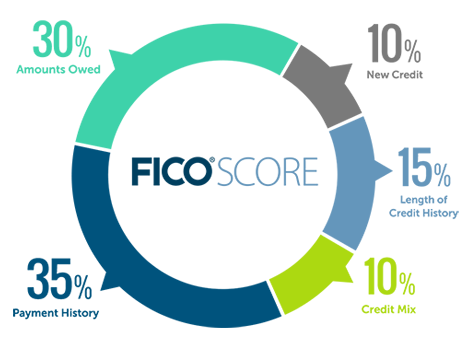

FICO does not reveal its proprietary formula for computing the credit score number. But it is known that the calculation incorporates five major components, with varying levels of importance. These categories, with their relative weights, are:

- Payment history (35%) – How often do you pay on time

- Amount Owed (30%) – How much you owe and its relation to your available credit

- Length of Credit History (15%) – How well-established your credit is

- New Credit (10%) – How many credit accounts and inquiries have you added recently

- Credit mix (10%) – what kind of debt you have (credit cards, loans, lines of credit, etc.)

What is a Good FICO Score?

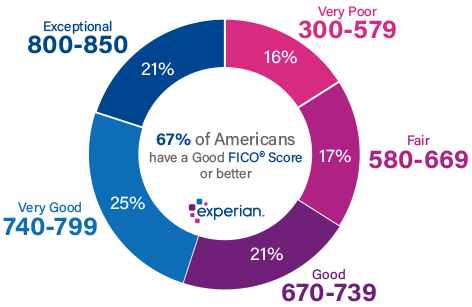

As stated earlier, a credit score can range from a low of 300 all the way up to 850. The higher the number, the better the credit score and the more attractive you are as a borrower.

For example, people with credit scores below 640 are generally considered to be subprime borrowers. As such, banks will charge interest on subprime mortgages at a rate higher than a conventional mortgage to compensate for carrying more risk. They may also require a shorter repayment term or a co-signer.

Conversely, a FICO score of 700 or above is considered good and may result in a borrower receiving a lower interest rate, which results in their paying less money in interest over the life of the loan. FICO scores greater than 800 are considered excellent and can result in even better loan terms.

Examples of Good and Bad FICO Scores

Check out this chart from Experian that shows the percentage of American households that have good and bad FICO scores. If you are trying to figure out what is a good FICO score and where mine fits in with the rest of the country, this graph will give you an idea.

The following are what is generally considered good and bad credit scores:

- Excellent: 800 to 850

- Very Good: 740 to 799

- Good: 670 to 739

- Fair: 580 to 669

- Poor: 300 to 579

Credit Score vs. Credit Report

Your credit report contains the data used to calculate your credit score. It contains personal information, credit account history, credit inquiries, and public records. This information is reported by your lenders and creditors to the credit bureaus.

Credit reports can be very long as they provide comprehensive information on your account history and how well you’ve paid off outstanding balances. They will also include any negative information such as late payments, repossessions, or bankruptcies.

There are three credit bureaus that compile the credit reports.

How do I find out what is in my credit report?

Legally, the three major credit bureaus must give you a free credit report once a year. You can get all three reports at the same time, or one at a time, throughout the year, which can help you keep a closer eye on your rating. You can obtain your free credit report at annualcreditreport.com.

If you are turned down for credit, you are also entitled to a free credit report from the credit bureau that provided the credit report score. You should receive information from the institution that declined your application explaining the reason for the decline and providing you with the contact information for the credit reporting agency that supplied your credit report. This communication is typically sent to you via mail.

What if I find an error on my credit report?

You have a legal right to have an error-free credit report. To be sure you do, verify your credit report information at least once a year. If you notice an inaccuracy, follow these steps:

- File a dispute with the credit bureau. Include detailed information and documentation. You can mail your dispute or file it online. If the bureau agrees it made an error, it must legally correct your report.

- File a dispute with the creditor. If the creditor reported inaccurate information to a credit bureau, it must inform the credit bureau of the mistake and have it corrected on your behalf.

- Amend your credit report if necessary. If you can’t prove the inaccuracy to the satisfaction of the credit bureau, you still have recourse. Credit bureaus must allow you to amend your report with a personal explanation, which will be visible to any institution accessing your report in the future.

These protections are put in place to be sure you are represented accurately and fairly to anyone requesting your credit history.

Credit Bureau Contact Information

- Equifax

(800) 685-1111

- Experian

(888) 397-3742

- TransUnion

(800) 888-4213

The Chase Reconsideration Line: What you need to know

The Chase Reconsideration Line: What you need to know