A VantageScore is a credit score jointly developed by the three major credit bureaus to predict how likely you are to repay borrowed money. It’s used by financial institutions and landlords to evaluate the creditworthiness of a prospective customer.

VantageScore was developed by the same three credit rating agencies—Equifax, TransUnion, and Experian—that are used by FICO to develop its scores. They claim to use “machine learning” techniques to generate a more accurate picture of a consumer’s credit. It’s the first and only tri-bureau credit scoring model and claims to have greater consistency, predictability, and accuracy.

This article will answer the question “What is a Vantage Score” as well as educate you on how it’s calculated and where you can get your’s for free

History of the VantageScore

VantageScore 1.0 was created in 2006. Its creation introduced competition in credit scoring industry that has fueled innovation and benefitted both lenders and consumers.

VantageScore 2.0 was launched in October 2010 in response to the substantial shifts in credit markets, most notably observed in single-family mortgage lending from 2007 to 2009 because of the Great Recession. This version reflects consumer behavior from multiple outcome periods over an extended timeframe, 2006 to 2009, to capture both non-recession and recession-period credit patterns.

VantageScore 3.0 was introduced in 2013. This model pairs industry-leading analytics with more granular data from consumers’ credit files to create a highly predictive and consistent credit scoring model. Early versions of the VantageScore provided a scoring range of 501 to 990 with corresponding letter grades from A to F and weighted factors differently. Version 3.0, however, switched to the same scoring range as FICO, 300 to 850, and eliminated the letter grades, making it easier to compare across the credit scoring models.

VantageScore 4.0 is the fourth generation of the credit scoring model. It offers predictive performance lift across credit industries, including auto, single-family residential mortgage, credit card, installment loans and other consumer credit products; outperforming VantageScore 3.0 in all major credit industries, with a significant overall predictive lift.

How’s it Calculated?

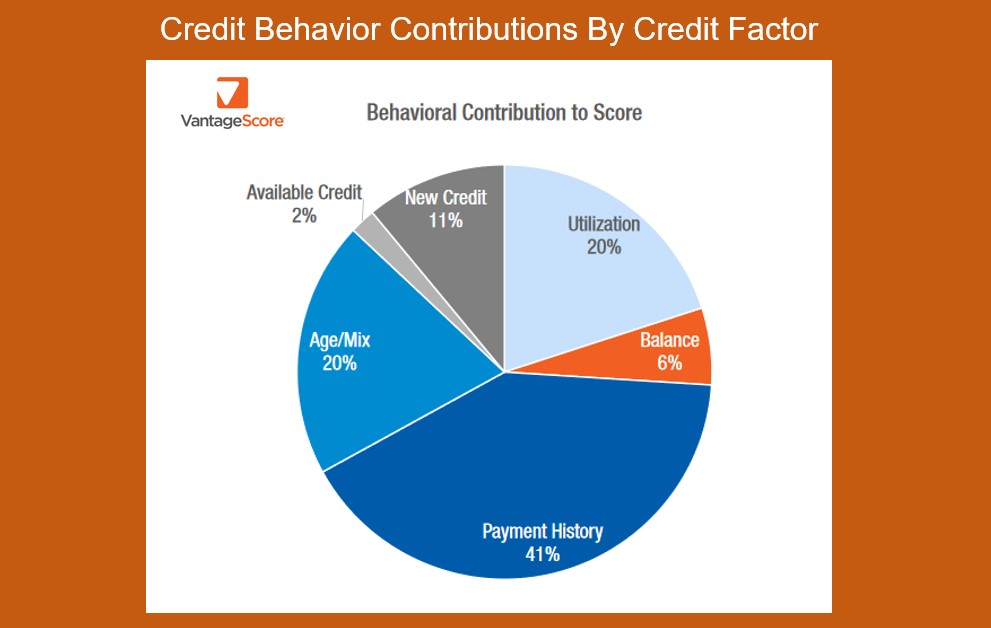

VantageScore prefers not to use percentages to describe how much weight it gives various credit factors, as FICO does, but instead describes them in terms of influence.

VantageScore Influences:

- Extremely influential: Payment history

- Highly influential: Type and duration of credit and percent of credit limit used

- Moderately influential: Total balances/debt

- Less influential: Available credit and recent credit behavior and inquiries

A VantageScore is determined using six factors:

- Payment history: 41%

- Age and type of credit: 20%

- Credit utilization: 20%

- Balances: 6%

- Recent credit: 11%

- Available credit: 2%

What’s a good score?

With the introduction of the VantageScore 3.0, the credit bureaus switched VantageScore’s scale from 501–990 to the 300–850 scale that lenders were used to from FICO scores. It’s up to each lender to decide on the minimum acceptable VantageScore that applicants need for a loan or credit card, but VantageScore breaks down the score ratings as follows:

Vantage Score Ranges:

- 781-850 – Excellent

- 661-780 – Good

- 601-660 – Fair

- 500-600 – Poor

- 300-499 – Very Poor

Anyone with a score below 600 is considered a Subprime Borrower.

VantageScore 3.0 vs. VantageScore 4.0

VantageScore 4.0 offers predictive performance lift across credit industries, including auto, single-family residential mortgage, credit card, installment loans and other consumer credit products; outperforming VantageScore 3.0 in all major credit industries, with a significant overall predictive lift.

The VantageScore 4.0 model has made a few changes to this formula, emphasizing payment history and new credit a little more and balances and depth of credit a little less. Here’s how it weighs each factor:

VantageScore 4.0 is determined using six factors:

- Payment history: 40%

- Age and type of credit: 21%

- Credit utilization: 20%

- Balances: 11%

- Recent credit: 5%

- Available credit: 3%

VantageScore vs. FICO

Both VantageScore and the FICO score operate on data stored in consumer credit files maintained by the three national credit bureaus. The models then conduct a statistical analysis on the data to predict the likelihood a consumer will default on a loan. Both VantageScore and FICO models represent the risk of a loan default in the form of three-digit scores, with higher scores indicating a lower risk.

A FICO score is determined using five key factors:

- Credit history: 35%

- Credit utilization: 30%

- Length of credit history: 15%

- Mix of credit: 10%

- New accounts opened: 10%

VantageScore 4.0 is determined using six factors:

- Payment history: 40%

- Age and type of credit: 21%

- Credit utilization: 20%

- Balances: 11%

- Recent credit: 5%

- Available credit: 3%

There are several points of difference between FICO and VantageScore. FICO creates a single bureau-specific score for each of the three credit bureaus, using only information from that bureau. As a result, it’s actually three scores, not one, and they can vary slightly, as each bureau will have different information about a consumer.

A VantageScore is a single, tri-bureau score, combining information from all three credit bureaus. FICO scores require a credit history of at least six months, but VantageScores can be calculated for individuals with a credit history that is less than six months old, allowing it to rate approximately 40 million more people than the FICO score.

How to Get a Your Score for Free

Today, you can select from a fairly large list of companies that will provide your VantageScore for free. Here’s a the list of these companies

They currently include:

- Credit Karma

- Credit Sesame

- The Credit Wise program from Capital One

- LendingTree

- NerdWallet

- SavvyMoney

- WalletHub

If you are a customer of one of four certain lenders, you also might have the option to get a free VantageScore through the lender.

They currently include:

When does my FICO Score Update?

When does my FICO Score Update?